Looking at the local numbers, it just doesn't seem true. While prices continue to trend downward little by little, the news folks would have us believe that that inventory is growing, no one can get financing, and no one is buying.

While the days of bidding wars happening the day properties hit the market may be over, and the buyers using stated income, 100% financing may be over long gone, the fact is that people continue to buy homes and the pace is picking up, and lenders are eager to loan money to people with decent credit.

The graph below shows inventory, pending, and sold for the past year. As you can see, pendings and closings have been rising for the past few months, while inventory continues to decline. Of the 88 sold last month, 20 were short-sales and 23 were bank-owned. That leaves 45 successful traditional, or 'equity' sales.

I'm not saying that we're experiencing a boom, nor that there won't be more foreclosures, but looking at current trends, if you've got a home to sell in Folsom, you've got buyers willing to buy. You won't get 2005 prices, but you'll get it sold.

This graph shows months of inventory. Most experts consider 5 to 6 months of inventory 'normal' or healthy. We've got less than 3 months.

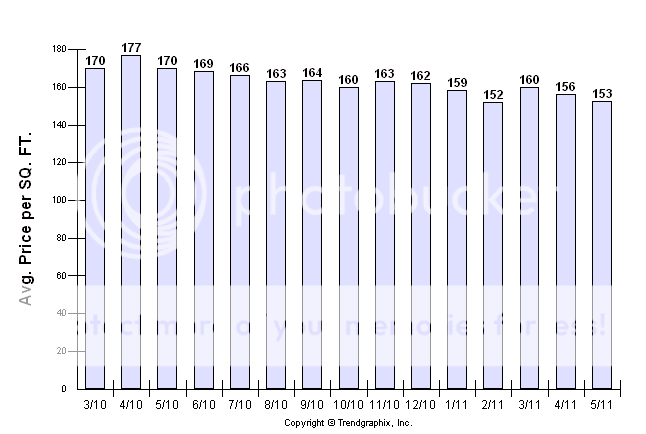

The graph below shows average price per square foot. It continues to trend downward, though the drops are not severe.

What are your thoughts? Are you surprised? Do you think we're seeing a healthy trend? Temporary spike? Waiting for the other shoe to drop?